-

1 知识点讲解

-

2 课件

【PART 01】Financial Analysis

Concept:The process of evaluating businesses, projects, budgets and other finance-related entities to determinetheir performance and suitability.

Function:

● To analyze whether an entity is stable, solvent, liquid orprofitable enough.

● Thereby gaining an understanding of the financial health ofthe company and enabling more effective decision making.

Review

Outcome 2 When looking at a specific company, a financial analyst conducts analysis by focusing on the income statement, balance sheet and cash flow statement.

Investors, shareholders,managers and other interested parties review financial statements for differentinformation, like we have discussed in outcome 1. The eight major informationusers and what they most concern.

Example:

Investors areused to engage the statements for the business long-term earning power.

Creditors willconsider the debts and interest payments that company owes, as well as its cashflow conditions.

Managementwill use all the information to review results and search for areas of untappedpotential.

Common financial statements analysis techniques

Include: Horizontal analysis, verticalanalysis and ratio analysis

【PART 02】Horizontal analysis

Concept:Horizontalanalysis allows investors and analysts to determine how a company has grownover time. Additionally, analysts and investors could use horizontalanalysis to compare a company's growth rates in relation to its competitorsand industry.

For example,when you hear someone saying that revenues increased by 10% this past quarter, that person is using horizontalanalysis.

【Example】

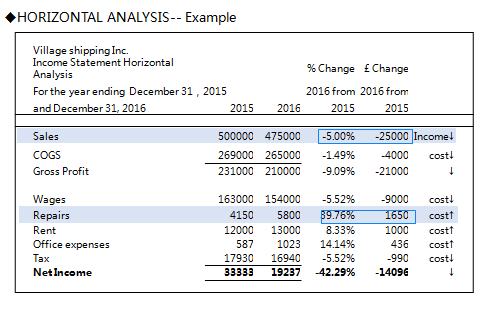

Let's see an example of horizontalanalysis. For useful trend analysis,you need to use more years (mostinvestors use five).

But here we only use two year data of thebusiness to show you how to prepare a horizontal analysis.

In this example, the analysis computes the percentage change in each account of the income statement.

The first number you might consider is the change in profit. Net income declined by 42.29 percent. Why? Which account contributed to the decline?

【PART 03】VerticalAnalysis

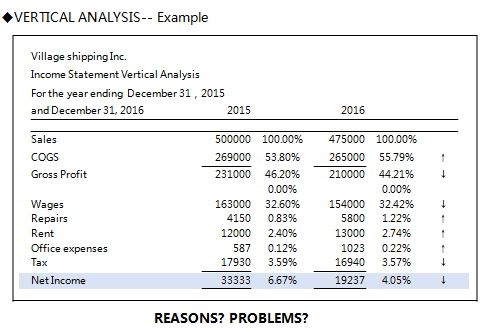

Vertical analysis prepares financialstatements that are adjusted as percentages of sales or other account categorytotals.

– Income statement, sales is commonly used as thedenominator.

– The balance sheet uses total assets, totalliabilities and total equity.

– In a cash flow statement, a percentage of thefirm’s total cash and cash equivalents.

Each line item of a financial statement asa representation of the percentage of the statement's larger number.

Vertical analysis is most often used in theincome statement.

So let's see an example of income statement.

【Example】

【Question】what are the reasons forthe decline of net income?

【PART 04】Ratio Analysis

Concept:Ratio analysis involves evaluatingthe performance and financial health of a company by using data from thecurrent and historical financial statements. Calculates statisticalrelationships between data.

Function:Ratio analysis can be used to

– compare a company's performance over time to assess whetherthe company is improving or not

– compare a company's financial standing with the industryaverage;

– or compare a company to one or more other companies operatingin its sector, we say the competitors. Whether it has the competitiveadvantages.