-

1 additional r...

-

2 课件

【Addtional Readings】

A number of different types of companies exist under the Corporations Act, and may be classified broadly as:

1. limited companies:

(a) proprietary companies with a share capital

(b) public companies with a share capital

(c) companies limited by guarantee, without any shares

2. unlimited companies, which may be proprietary or public companies, both of which must have a share capital

3. no‐liability companies

4. special companies:

(a) investment companies

(b) banking companies

(c) life insurance companies.

Limited companies

One of the main reasons for setting up a company is that the corporate form of organization permits individuals to have limited liability in relation to personal funds they are required to contribute to the company. Under corporate legislation, the shareholders in a limited company are liable only to the extent of the amount unpaid on their shares up to the full issue price of those shares.

Contrast this with the partnership form of organization in which each partner is personally liable for all partnership debts, i.e. unlimited liability. If one or more partners are insolvent, the remaining solvent partners must meet all losses and debts out of their private assets. This principle of unlimited liability also applies to a sole trader.

A limited company is required by corporate legislation to have the word ‘Limited’ or the contraction ‘Ltd’ at the end of its name. It can be either ‘proprietary’ or ‘public’.

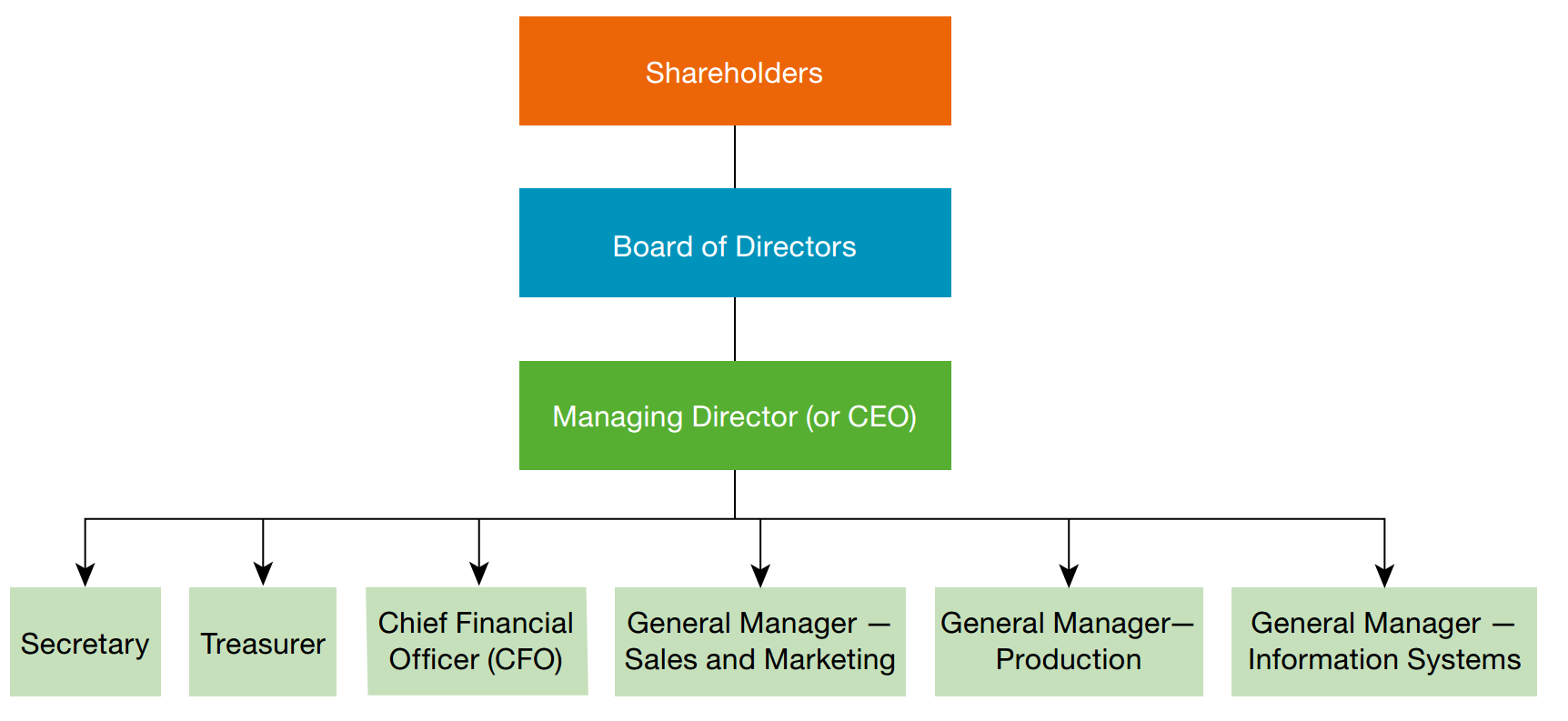

Organization chart — public company

Companies limited by guarantee

A company limited by guarantee is also a public company, whose members undertake to contribute a guaranteed amount if the company is wound up. Companies of this type are commonly associated with special events such as an arts festival or sporting event.

For example, in Australia, the Corporations Act, from 2010 onwards, also distinguishes between large and small companies limited by guarantee. Small companies of this type are exempted from having to comply with certain accounting standards.

Unlimited companies

In an unlimited company, members are liable for all debts of the company. The unlimited company is not common in Australia and exists to some extent among mutual funds, a type of investment company.

No‐liability companies

A no‐liability company is a public company that does not have a right to require shareholders to make any contribution towards the debts of the company; there is no liability on the part of shareholders to pay any calls on shares. Non‐payment of a call leads to automatic forfeiture of shares. Such a company

must engage solely in mining activities, and must have the words ‘No Liability’ or the abbreviation ‘NL’at the end of its name.

Special companies

Investment companies

An investment company is a special type of company that is engaged mainly in the business of investment in marketable securities for the purpose of earning profits, and not for the purpose of exercising control. It is subject to certain restrictions on borrowing, on investment in other companies, on holding shares in other investment companies, and on speculation.

Banking companies

A banking company is defined as any bank constituted under a law of a state or territory or as defined in the Banking Act. Under corporate legislation, banks are given certain privileges and special provisions

regarding the issue of a prospectus for the purpose of subscribing for debentures and the presentation of financial statements.

Life insurance companies

A life insurance company is registered under the Life Insurance Act. It is subject to special requirements regarding the preparation and presentation of annual financial statements.