-

1 知识点讲解

-

2 Trial balance

-

3 课件

【REVIEW】Basic accounting equation

1. Transactions result in changes in assets, liabilities and owner's equity

2. Every transaction affects at least 2 components of the accounting equation

3. After each transaction is recorded the equation is still inbalance.

【PART 01】Double-entry accounting复式记账法

Double-entry accounting is a standard accounting method that involves each transaction being recorded in at least two accounts.

Principle of bookkeeping

Bookkeeping is based on the principle that every transaction has 2 effects

For example:

if you buy a computer paying by cash, you have:

1. One more computer than before

2. Less money than before

Key terms

1. ACCOUNT

An account provides a record of increases and decreases in each item that appears in the financial statements.

2. GENERAL LEDGER

All the accounts maintained by an entity to enable preparation of the financial statements are collectively called the general ledger.

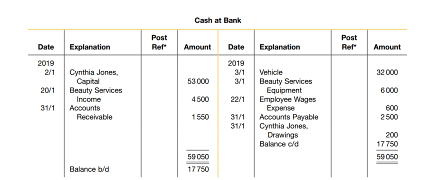

3. T- ACCOUNT

Concept:The simplest account structure is shaped like the letter T.

Characteristic:Each account has three basic parts

● Title

● Place for recording increase

● Place for recording decrease

Key point:

Debits are recorded on the left side of a T account in a ledger.

Credits are recorded on the right side of a T account in a ledger.

【难点】需要注意:DEBIT 借方 CREDIT 贷方

其实并没有字面上借贷的含义,它们表示的只是T型账户的左右两边。

【PART 02】Debit And Credit Rules

1. Every financial transaction gives rise to at least two accounting entries, one a debit and the other a credit.

2. The total value of debit entries in the nominal ledger is therefore always equal at any time to the total value of credit entries.

3. Therefore, the accounting equation always remained in balance.

Key Principle:

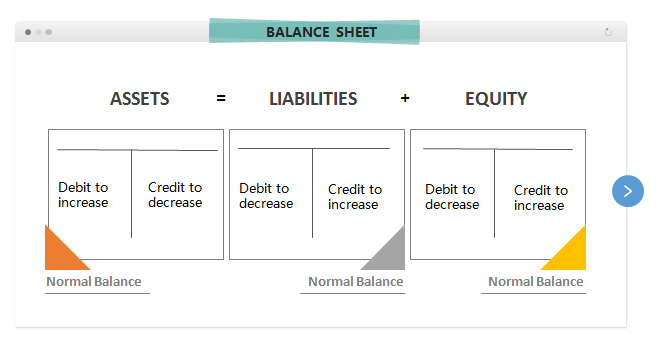

Double-entry bookkeeping is governed by the accounting equation.

Assets-liabilities= owner’s equity

also: Assets - liabilities = Capital – drawings+ revenue – expenses

convert to: Assets + Expenses = Owners’ Equity+ Revenue + Liabilities

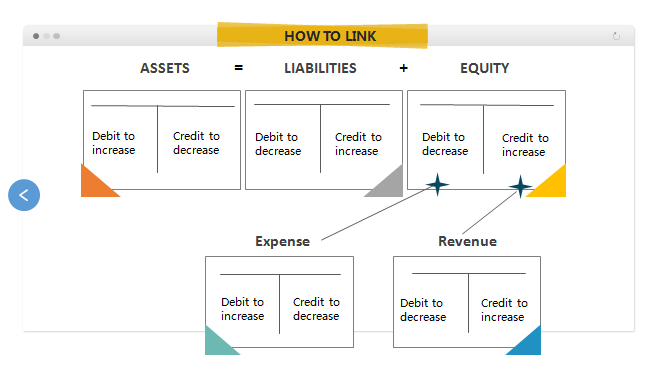

so, Debit credit rules of accounts in balance sheet:

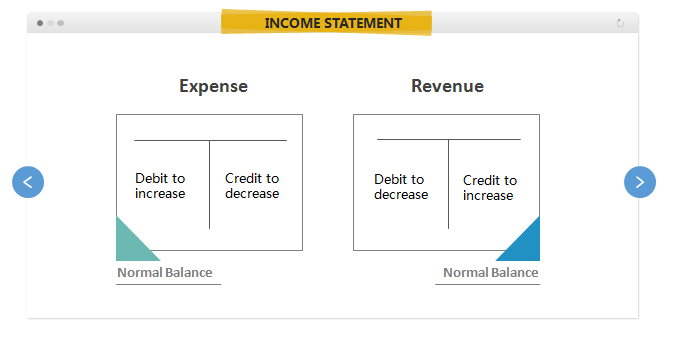

Debit credit rules of accounts in income statement:

Relationships between accounts in balance sheet and income statement:

![]()

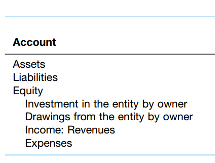

Normal Balance

The normal account balance is the side on which increases to the account are recorded.

It is helpful to know the normal balance for an account when looking for ledger errors.

![]()

【Example】Four steps to double-entry bookkeeping

Bought a van for £9,000 paying by cash

1. What two accounts are involved?

2. What types of accounts are they?(assets, liabilities, income, expenses, capital)

3. Are they going up or down?

4.how do we debit or credit these accounts

T transaction has an equal amount of debits and credits. In other words, the books ‘balance’.